3 Things Business Owners Should Know About Business Interruption Insurance

10/29/2019 (Permalink)

Learning about business interruption insurance can be a useful way you can prepare your business for a storm

Learning about business interruption insurance can be a useful way you can prepare your business for a storm

Most business owners in North Scottsdale,AZ, never imagine that their business will have to close its doors, even temporarily. However, storms can cause major damage to businesses, and it's often necessary to restore and rebuild after a disaster. Before damage occurs, it can be useful to learn about the benefits of business interruption insurance.

How Do You Know if You Need Interruption Insurance?

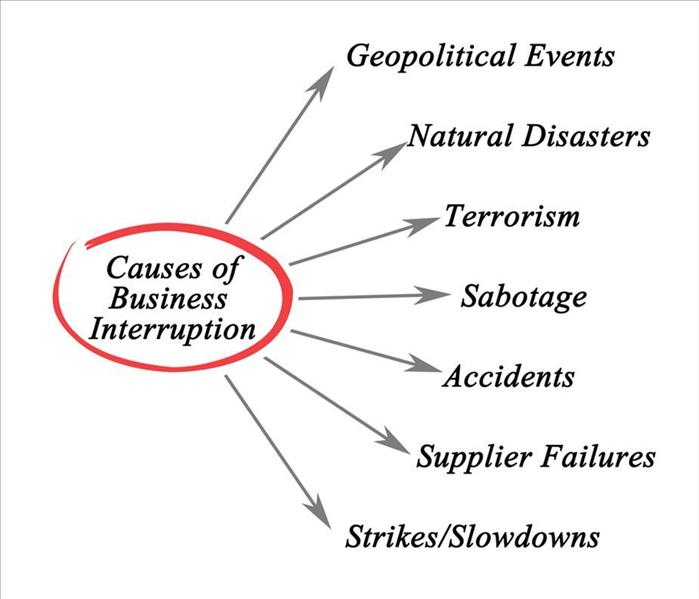

Determining what type of insurance policies will be useful to your business if a disaster occurs can feel overwhelming initially. In many situations, a business must temporarily close after a disaster such as a storm has occurred, and costs can quickly add up without income from the business. If you cannot adequately cover the costs of your business closing for an extended period of time, then it's often wise to purchase interruption insurance for your commercial property.

What Is Interruption Insurance?

There are usually a variety of costs associated with maintaining a business that has been affected by a storm. In order to return a business to its previous state, restoration, or even a rebuild, may be necessary, and business can't continue as usual during these processes. Interruption insurance for businesses ultimately helps a business stay afloat if it's necessary to shut down after a disaster occurs. This insurance will cover lost revenue, employees' wages and operational expenses while your business is closed.

How Does Interruption Insurance Vary From Other Types of Insurance?

When it comes to protecting your business, there are various insurance policies to choose from. Though flood, fire and other types of insurance usually help to cover the cost of emergency restoration services, these policies won't cover the continuing costs of maintaining your business when it is closed. As a result, many business owners without interruption insurance must face the burden of paying for the operation of the closed business.

Learning about business interruption insurance can be a useful way you can prepare your business for a storm. When you know your expenses are covered after a storm, a rebuild and restoration can become your primary focus.

24/7 Emergency Service

24/7 Emergency Service